Feb 29, 2020 | Feature |

It is tax season and that means that college students who file are most likely getting refunds.

If you worked a lot in 2019 the chances are your refund is large. If you’re not behind on bills or desperately need to spend the money, this is a good chance to get ahead on your savings and build an emergency fund.

There are also many ways you could invest this money rather than using it for quick purchases that provide momentary satisfaction. Saving your money to use on textbooks next fall, using it as grocery money for the semester, paying rent, or investing it into your long term savings account are all really good ways for spending your refund wisely.

Making conscientious purchases such as those will benefit you in the long run, rather than using it to go out to dinner, to buy your 7th pair of Vans or a new sweatshirt.

Be smart with your refund and be sure to file your taxes with us by setting up an appointment with a peer coach by contacting caleb.grover@maine.edu.

Feb 24, 2020 | Feature |

Kathleen Perry Contributing Writer

The UMF Financial Literacy Peer Education Program (FinLit) helps students gain control of their finances through exciting events, including the upcoming Tacos and Taxes.

FinLit Coordinator Sarah Hinman said that the event will provide the help of peer educators, all of whom are certified tax preparers, as well as the ability for students to get their taxes filed for free, with a feeling of empowerment and free food. The peer educators will also be working with Hinman and volunteers from United Way.

FinLit’s Tacos and Taxes drew in about 30 students last year. Some individuals only needed a small amount of assistance, but the people within the FinLit Program also helped those who had never filed before and were “desperate to take charge of their tax situation,” said Hinman.

Taxes and Tacos was designed to provide a more cost-efficient and attractive alternative to the average tax-filing process. FinLit and Hinman recommend coming to this program instead of using another tax preparation service, such as Turbotax or H&R Block because it is free, there is food, and it is empowering. “Money equals power, and being able to handle your finances independently also equals power,” said Hinman.

The empowerment comes from students being able to have a hand in their tax preparation process, and allows them to be active within it. Being able to file one’s taxes and see the process creates a feeling of pride and confidence. “Tax events are very effective for the people that come,” said intern Caleb Grover.

Part of what makes the FinLit tax filing experience unique is the peer educators who are there to make the process as easy as possible. “There’s somebody to talk to and we know what we’re talking about,” Grover said with confidence. “If an issue comes up with your taxes, we would be the one to reach out to someone for you–you aren’t on your own.”

According to a previous article published in The Flyer, the FinLit program was formed last year following a donation of $901,000 from Janet Mills, governor of the state of Maine, to fund the program which was set to be put into place at all public universities in Maine by 2021.

FinLit helps with more than just taxes throughout UMF. “We provide a safe space for students to come and receive guidance or help on their different financial issues,” Hinman said. “That can range from understanding your bill better, reviewing what you owe for student loans and how much the monthly payment will be.”

Tacos and Taxes will take place on Tuesday, Feb. 25 in the Education Center lobby from 10 a.m. to 4 p.m. Students are encouraged to bring their laptop and their appetite. Students can also visit the FinLit office hours Monday through Friday. To make an appointment, contact them through email or direct message on Instagram.

For future updates and opportunities for financial advice follow FinLit on Instagram @umf_finlit or email caleb.grover@maine.edu or sarah.hinman@maine.edu.

Nov 7, 2019 | Exclusive |

Dam Turkey Day

The time to stuff our faces with turkey, stuffing, and pies is nigh. Images of a heaping cornucopia of steaming food can cloud our vision and financial judgment. Cooking a traditionally large, exquisite Thanksgiving meal can be enough to break anyone’s budget.

Before you decide what you’re cooking, set aside a budgeted amount of money. Setting a limit will steer you away from splurging and losing track of your food spending until the final item has been rung up.

The meat of a Thanksgiving meal is generally the most expensive item on the table. This may be controversial, but maybe you don’t need a whole turkey. Turkey’s breasts, thighs, and drumsticks will be cheaper and cook faster than a whole turkey, saving you time and money.

When it comes to vegetables and pies don’t shy away from canned or frozen goods. After it’s been cooked, the only noticeable difference will be in your wallet.

After completing your Thanksgiving budget, break out your phone and use a coupon or savings app to see what deals you can find on the items you’ve chosen.

On top of saving all that dam money, don’t forget to be thankful for the loved ones around you- they’re priceless. DM FinLit on Instagram at Umf_Finlit or send me an email at caleb.grover@maine.edu to set up an appointment.

Oct 24, 2019 | Exclusive |

Give Me My Dam Money!

Dam Credit Scores: How interest rates and credit scores could ruin your life.

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Understand that interest accrued over the life of any loan is how banks and lenders make money off of us, the borrowers. And your credit score is the measure by which lenders decide what interest rate you will receive.

There is a stark contrast in the amount of interest you will pay when buying a car with a superprime credit score as opposed to doing so with a subprime credit score. For example, the interest paid on a car loan worth $20,000 with a credit score above 780 (superprime) will be roughly $1,000 over fours. However the interest payment on a car loan of the same amount and same repayment period but with a credit score below 600 (subprime) would be nearly four times as much. It doesn’t have to be a car, it could be a house or a boat, or any other large purchase.

Building a good credit score now while you are in college will make your life much easier after graduation and save you thousands, if not hundreds of thousands, of dollars.

Contact the Financial Literacy Peer Education Program to begin taking control of your credit today! DM us on Instagram at Umf_Finlit or send me an email at caleb.grover@maine.edu to set up an appointment.

Oct 24, 2019 | News |

Leanna Farr Contributing Writer

When it comes to finances, the UMF Financial Literacy Peer Educators (FinLit), is the place to go. The program was created last year after Janet Mills, former state attorney general and the current governor of the state of Maine, donated $901,000 to a grant to fund the program which was set to be implemented at all seven public universities in Maine by 2021.

FinLit provides various financial services, such as one-on-one appointments and exit loan counseling on top of organizing presentations and events. The peer educators are experts on FAFSA, credits, loans, budgeting, investing, taxes, and saving.

With coordination from Sarah Hinman, the Financial Literacy Peer Education Coordinator, UMF was the first campus to implement the financial literacy program. Hinman has implemented the same program at the University of Maine at Augusta and University of Maine at Orono this year.

Caleb Grover, a senior business economics major, has been a peer educator since the program began last year. “Our most popular service is filing the FAFSA with students,” said Grover. “One of the program’s missions is to increase the number of students filing their FAFSA in the state of Maine.” Only around 40% of students are filing their FAFSA to receive financial aid, grants and work-study.

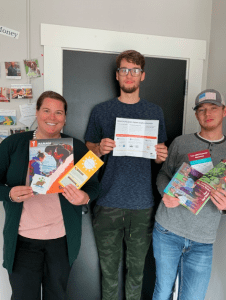

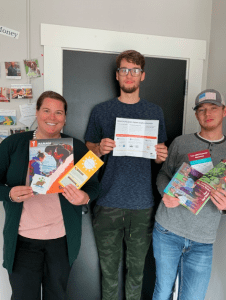

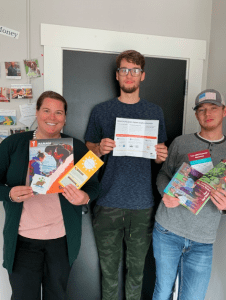

Sarah Hinman, Jacob Leonard, and Caleb Grover, Members of the #FinLit Squad (Photo courtesy of Leanna Farr)

To try and help students with filing their FAFSA, FinLit held an event where peer educators helped students file their FAFSA for free while eating cake. They also advertised a drawing for a $25 gift card. “It went really well, even better than last year which went really well for the first year having it,” Grover said. “This year there was even higher attendance. There was at least one student there at all times.”

“The key to our success is definitely partnering with other offices to promote and have support for bigger campus-wide events,” Hinman said. They achieve this by giving presentations for admissions with visiting high school students and working with the career services and Merrill Hall.

When discussing the work as a peer educator Grover said “it’s a professional but relaxed environment where we help students face challenges so they don’t make the same mistakes we did.” Working with other students has made him realize “there are a lot of situations you don’t realize are going on until you hear someone’s situation,” he said, “it is grounding working with people that have it a lot worse than you and you offering them help.

Jake Leonard, a junior in the computer science major, also works as a financial peer educator. “There is a lot going on with other student’s finances that you wouldn’t expect. Some people come it not knowing that they owe $30,000 and others are really stressed but only owe a minimal amount,” he said. “There’s a visible weight lifted when people come in and sit with us and understand.”

For more information about upcoming events, learn more about the peer educators, and get financial tips, check out their Instagram @umf_finlit. The peer educators can also found in room 201 at Franklin Hall.